Source: URA

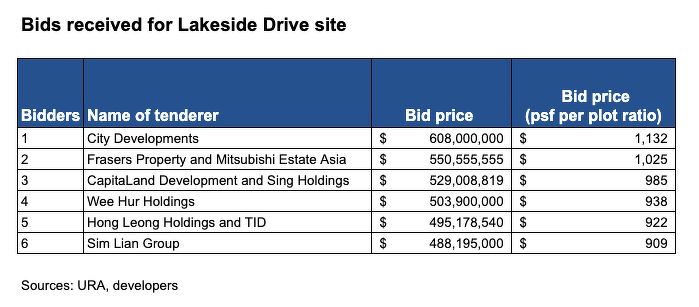

City Developments Limited (CDL) emerged as the top bidder for the Lakeside Drive site, submitting a bid 10.4% higher than the second-highest offer of $550.56 million ($1,025 psf ppr) by Frasers Property and Mitsubishi Estate Asia.

In third place was CapitaLand Development and Sing Holdings, with a $529 million bid ($985 psf ppr). Other bids came from Wee Hur Holdings ($503.9 million or $938 psf ppr), a Hong Leong Holdings-TID joint venture ($495.18 million or $922 psf ppr), and Sim Lian Group ($488.2 million or $909 psf ppr), showing a 24.5% spread between highest and lowest bids—highlighting market uncertainty.

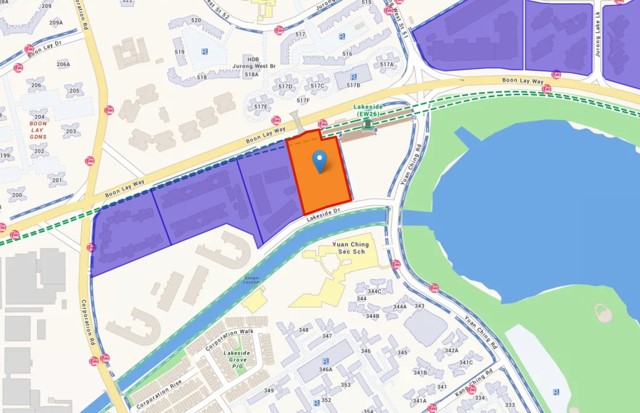

The 145,314 sq ft Lakeside Drive site, zoned for residential with commercial use on the first storey, has a 3.6 gross plot ratio and can yield 575 residential units and 10,764 sq ft of commercial space. Located beside Lakeside MRT Station, the site offers excellent connectivity. CDL plans to develop five 16-storey residential blocks with a retail podium on the ground floor, providing unblocked views of Jurong Lake Gardens.

CDL group CEO Sherman Kwek describes the site as a strategic addition to its pipeline due to its location near the Jurong Lake District and rich amenities. Analysts see this tender as a turnaround from the lukewarm response to recent GLS sites, such as Media Circle (Parcel B), which attracted zero bids, and Lentor Gardens, which drew only two. In contrast, the Bayshore Road site, tendered before the April tariffs announcement, drew eight bids.

Leonard Tay, head of research at of Knight Frank, believes the site’s appeal outweighed cost concerns. PropNex’s head of research and content Wong Siew Ying highlights that no condos have launched nearby since 2016’s Lake Grande, suggesting pent-up demand from HDB upgraders in Jurong. If CDL is awarded the site, the $1,132 psf ppr rate would be among the highest in the Outside Central Region (OCR), surpassed only by Bayshore Road and Clementi Avenue 1.

Wong estimates future selling prices around $2,400 psf. ERA Singapore’s CEO Marcus Chu expects the project to set a new benchmark in Lakeside, outperforming recent launches like The LakeGarden Residences ($2,134 psf median) and Sora ($2,216 psf). With only 327 units remaining in both, and nearly 2,900 HDB flats in Jurong West reaching their minimum occupation period in the next five years, demand for private homes is expected to rise.

Read full article here.

Leave a comment